How Can You Save More with Takaful myClick Motor FlexiSaver?

For decades, we have been paying an annual contribution for motor coverage against accidental damage even though the vehicle is not driven.

With Takaful myClick Motor FlexiSaver, you only pay when you drive and enjoy the following benefits:

Automatically Covered for One Full Year As Base FlexiCover

Injury to third party

Damage to third party property / vehicle

Fire or theft to your vehicle

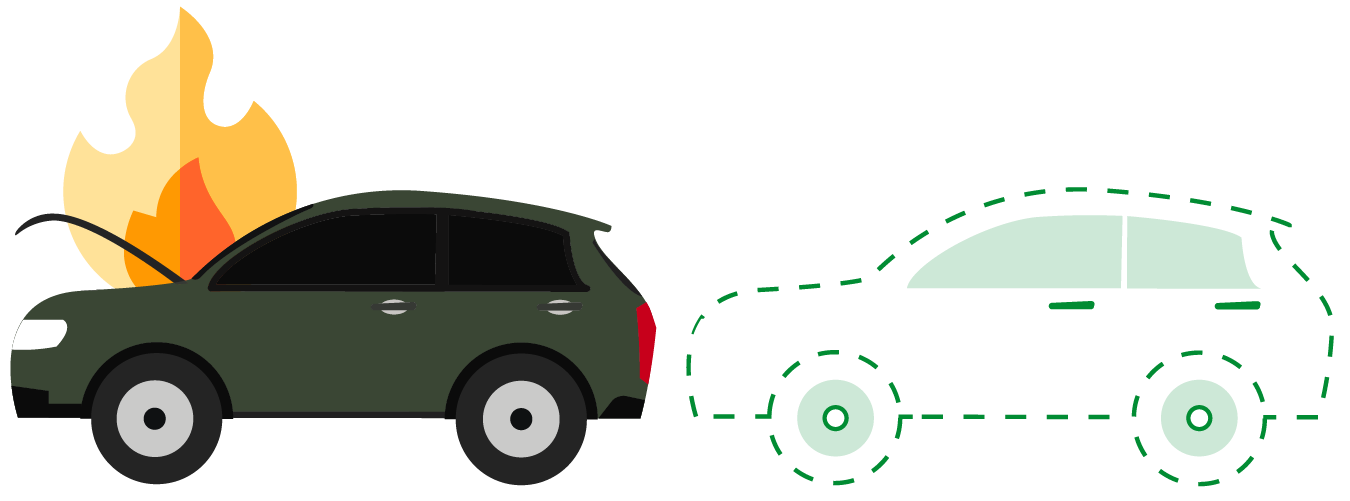

Activate Pay As You Drive Daily Cover

OPTIONAL

Damage to your vehicle

With Pay As You Drive daily cover, you can choose to activate only when you drive. You will only be charged for the days driven,

which helps protect you against costs incurred due to damages caused to your vehicle in the event of an accident.

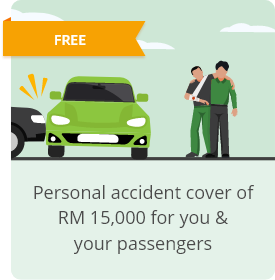

Get the FREE benefits too when you activate the Pay As You Drive daily cover with an instant 10% discount.

Important Notes:

a.

You need to activate the Pay As You Drive daily cover by 11.59pm a day before your coverage starts on the next day.

b.

The coverage for Pay As You Drive starts from 12am and ends at 11.59pm on daily basis.

c.

Your total contribution for Takaful myClick Motor FlexiSaver will be higher than Takaful myClick Motor (Comprehensive Cover) if you activate the Pay As You Drive daily cover for more than 150 days in a year.

Find out how you can save under Takaful myClick Motor FlexiSaver compared to Comprehensive Cover under Takaful myClick Motor.

Scenarios

Potential Savings*

Base FlexiCover Only

70%

Base FlexiCover + Activate Pay As You Drive Daily Cover Once per Month

65%

Base FlexiCover + Activate Pay As You Drive Daily Cover Twice per Month

59%

Base FlexiCover + Activate Pay As You Drive Daily Cover Once per Week

47%

Base FlexiCover + Activate Pay As You Drive Daily Cover Twice per Week

24%

* The above sample is for illustration only, and it is based on certain assumptions of driver and vehicle profile.

The contribution may also vary depending on the vehicle’s cubic capacity and sum covered. The savings thus may vary too.

Takaful myClick Motor FlexiSaver At A Glance

Full year cover for loss or damage to your vehicle from fire or theft as well as third party bodily injury, death or property damage.

Daily protection for your vehicle against accidental damage on the road when you activate Pay As You Drive daily cover.

Add-on protection options for your windscreen, personal accident and key replacement.

Complimentary personal accident cover for you and your passengers with Pay As You Drive daily cover.

All authorized drivers are automatically covered at no additional cost.

Unlimited towing service for up to 50km.

How to Apply Takaful myClick Motor FlexiSaver?

Step 1

Enjoy an instant 10% discount when you apply for Takaful myClick Motor FlexiSaver on our website or

![]() app.

app.

Step 2

Activate Pay As You Drive daily cover before your road trip on the

![]() app.

app.

*Additional contribution shall apply.

Step 3

Make payment and start driving with peace of mind.

Enjoy FAST & EASY Tele Bantuan Services via  App

App

In the event of an emergency, submit the request via the app for immediate assistance.

Plus, monitor the tow truck real-time location and search for a panel workshop via the app.

Click here to know more about our roadside assistance program.

Breakdown Towing

(Free up to 50km)

Tyre Change

Fuel Delivery

Battery Change /

Jump Start

Accident Towing*

*Only if your vehicle is protected with Pay As You Drive daily cover at the point of an accident.