Takaful myClick MediCare

The medical plan that responds to real needs and respects your budget.

Who says that good medical protection should be a privilege of the wealthy?

When you don't keep thousands in the bank for emergencies, even an average hospital bill can seriously strain your finances - let alone a serious medical crisis. Which is why it's even more important to have reliable medical coverage that respects your budget and doesn't cost you a fortune.

Takaful myClick MediCare lets you enjoy total peace of mind by taking care of your medical bills with no cost sharing up to age 85!

.jpg)

RM35,000 - RM75,000

RM10,000 - RM30,000

RM18,000 - RM50,000

RM15,000 - RM40,000

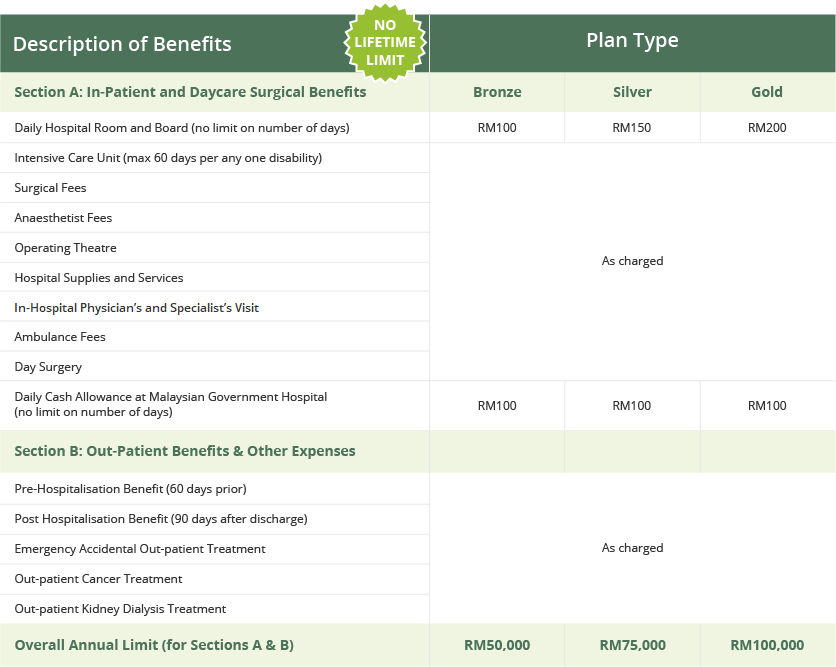

Choose from 3 affordable plans... and count on all of these benefits:

Full coverage for in-patient and out-patient benefits

No co-payment even when you upgrade your R&B

No lifetime limit up to age 85

Enjoy up to RM100,000 annual protection covering a wide range of in-patient and out-patient expenses – including follow-up and recovery costs for up to 90 days after discharge!

There is no limit on the number of days for Room & Board (R&B) accommodation, up to the annual limit of your chosen plan. If you upgrade your R&B, you just need to pay the difference on the R&B charge and the limit.

Your high Annual Limit is reinstated every year up to age 85 years as long as your certificate remains in force - and there is no lifetime limit regardless of the number of claims you make each year.

Full coverage for in-patient and out-patient benefits

No co-payment even when you upgrade your R&B

No lifetime limit up to age 85

How much are the hospital room rates in my area?

Get your personalised quote

Like with every protection plan, there are a few things which are not covered.

This means that you will not be able to make a claim for events including (but not limited to):

- Pre-existing medical conditions.

- Illnesses that occur during first 30 days of coverage.

-

Specific illnesses, such as Hypertension, Cancers etc., that occur during the first 120 days of coverage.

- Participating in an excluded activity such as war, unlawful activities or hazadous sports.